GInsure Bill Protect Group Personal Accident Insurance Policy

Group Policy Number: GCASH00011

Contents

- PLEASE READ THIS POLICY

- SECTION 1 – INSURING AGREEMENT

- ELIGIBILITY

- SECTION 2 – DEFINITIONS

- SECTION 3 – BENEFITS

- SECTION 4 – EXCLUSIONS

- SECTION 5 – GENERAL CONDITIONS

- Privacy Statement

- Contact Us

- About Chubb in the Philippines

PLEASE READ THIS POLICY

Please review this Group Policy and return immediately to Insurance Company of North America (a Chubb Company), hereinafter called the “Company”, if any errors are found.

SECTION 1 – INSURING AGREEMENT

In consideration of the statements in the policy application or other acceptable means of enrollment, which shall be the basis of this contract and whose original copy or proof is filed with the Company, and made a part of this Group Policy, upon the payment of premium and subject to all the exclusions, provisions and other terms of this Group Policy, the Company hereby insures the persons named, hereinafter called the “Insured”, against loss indicated as covered in the Policy Schedule occurring during the term of this Group Policy.

IN WITNESS WHEREOF, the Company has caused this Group Policy to be executed and commenced on the Effective Date stated in the Policy Schedule, provided that no insurance shall be in force unless the Policy Schedule is signed by an authorized representative of the Company.

(The Insurance Commission of the Philippines, with offices in Manila, Cebu, and Davao, is the government office in charge of the faithful execution and enforcement of all laws relating to insurance and has supervision over insurance companies. It is ready at all times to render assistance in settling any controversy between an Insurance Company and an Insured relating to insurance matter.)

ELIGIBILITY

To be eligible for cover, the Insured must be a Philippine Resident and between the ages of eighteen (18) years and seventy -five (75) years on the Effective Date of the Group Policy.

SECTION 2 – DEFINITIONS

The following terms when used with capital letters in this Group Policy shall have the meaning set forth below:

1. Accident or Accidental means a sudden, external and identifiable event that happens by chance and could not have been expected from the perspective of the Insured. The word Accidental shall be construed accordingly.

2. Accidental Death means death occurring within one hundred and eighty (180) days from the date of the accident as a result of a Bodily Injury.

3. Benefit Amount means the benefit amount payable by the Company as stated in the Policy Schedule.

4. Bodily Injury or Injury means a bodily injury resulting solely and directly from an Accident and which occurs independently of any illness or any other cause, where the bodily injury and Accident both occur during the Period of Insurance and while the person is an Insured. Bodily Injury includes illness or disease resulting directly from medical or surgical treatment rendered necessary by any Bodily Injury.

5. Company or Us or Our or We shall mean Insurance Company of North America (a Chubb Company).

6. Confirmation of Cover shall mean the document in PDF copy issued by the Company to the Insured which describes in general the insurance protection to which the Insured is entitled to under the Group Policy. The Confirmation of Cover can be accessed by the Insured via the unique link indicated in the Short Message System (SMS) sent through the Policyholder’s GCash system. Any Confirmation of Cover in effect when the Group Policy is cancelled, non-renewed or otherwise terminated shall continue to be in effect for the period of coverage specified in the Confirmation of Cover.

7. Event(s) means the Event(s) described in the relevant Table of Events set out in this Group Policy.

8. Effective Date means the date on which this Group Policy commences as stated in the Policy Schedule.

9. Expiry Date means the date on which insurance under this Group Policy expires or ends as stated in the Policy Schedule.

10. Fingers, Thumbs or Toes means the digits of a Hand or Foot.

11. Foot means the entire foot below the ankle.

12. Group Policy means this policy wording, the policy application, the Confirmation of Cover and the Policy Schedule describing the insurance contract between the Policyholder and the Company. It shall also include, after this Group Policy has taken effect, any amendment, rider, clause, warranty, endorsement or any other document attached to this Group Policy and which has been endorsed by an executive officer of the Company and countersigned by the Policyholder.

13. Hand means the entire hand below the wrist.

14. Insured means a GCash App user who enrolls his bill payment transaction for insurance cover under this Group Policy and pays the corresponding premium due using the policyholder’s GCash App.

15. Limb includes a hand or foot.

16. Loss means in connection with:

(a) a Limb, Permanent physical severance or Permanent total loss of the use of the Limb having lasted twelve (12) consecutive months and at the expiry of that period is beyond hope of improvement;

(b) an eye, total and Permanent loss of all sight in the eye;

(c) hearing, total and Permanent loss of hearing;

(d) speech, total and Permanent loss of the ability to speak;

(e) Hand, Foot, Fingers or Toes, loss of use of or Permanent severance through or above a metacarpophalangeal metatarsophalangeal joint; and which in each case is caused by Bodily Injury.

17. Period of Insurance means the period of time between the Effective Date and the Expiry Date as shown in the Confirmation of Cover, and for which cover applies under the Group Policy.

18. Permanent means having lasted twelve (12) consecutive months from the date of the Bodily Injury and at the expiry of that period, being beyond hope of improvement.

19. Permanent Total Disablement means where in the opinion of a Physician, the Insured is entirely and continuously unable to engage in, perform or attend to any occupation or business of any and every kind for the remainder of their life and said disability is Permanent.

20. Philippine Resident means a Filipino citizen or a Philippine permanent resident.

21. Physician means a doctor or specialist who is registered or licensed to practice medicine under the laws of the country in which they practice. A Physician cannot be: (a) the Policyholder; (b) the Insured; (c) a relative of the Insured, a member of the immediate family of the Insured.

22. Policyholder means Globe Fintech Innovations Inc., doing business as Mynt.

23. Policy Schedule means the relevant policy schedule attached to this Group Policy issued by the Company to the Policyholder.

SECTION 3 – BENEFITS

A. ACCIDENTAL DEATH BENEFIT

If the Insured suffers Accidental Death, the Company will pay the Accidental Death Benefit Amount specified in the Policy Schedule or Confirmation of Cover at the time of the Accident causing the Insured’s Accidental Death. The Company will pay the Accidental Death Benefit Amount to the person or persons then surviving in the order or preference as indicated under the provision entitled “To Whom the Benefit is Payable”.

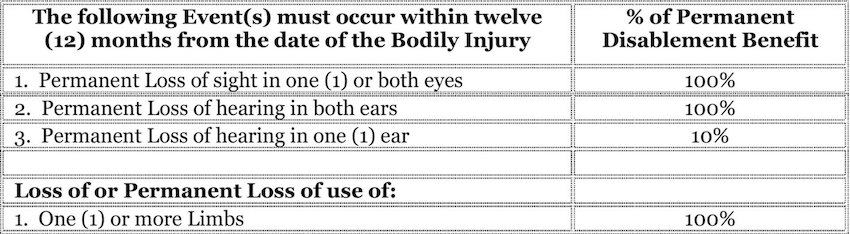

B. PERMANENT DISABLEMENT BENEFIT

If the Insured suffers an Event as set out in the Table of Events as a result of a Bodily Injury and a Physician certifies this, the Company will pay the Insured the Permanent Disablement Benefit limit specified in the Policy Schedule or Confirmation of Cover at the time of the Accident causing the Bodily Injury. The Company will pay the Permanent Disablement Benefit Amount to the Insured.

Table of Events

The maximum total amount the Company will pay under the Permanent Disablement Benefit is the sum specified in the Policy Schedule or Confirmation of Cover and no further benefits are payable under this Group Policy or any renewal or replacement policy.

Any existing disability will be taken into account in assessing the amount of benefit payable.

SECTION 4 – EXCLUSIONS

This Group Policy will not apply to any Event arising, directly or indirectly, out of:

1. deliberately self-inflicted injury, suicide, criminal or illegal act;

2. being under the influence of alcohol or unprescribed drugs;

3. engaging in any professional sport, meaning, Insured’s livelihood is substantially dependent on income received as a result of Insured’s playing sport;

4. engaging in any motor sports as a rider, driver and/or a passenger;

5. any consequences of, or the Insured taking part in, any war (whether declared or not), invasion, rebellion, insurrection, civil war, riot or civil commotion;

6. engaging in military duty with any armed forces of any country or international authority or while on duty in any paramilitary, police, police auxiliary of firefighting organization;

7. engaging in (or practicing for, or taking part in training particular to) aqualung or scuba diving, climbing or mountaineering necessitating the use of ropes or guides, pot holing, parachuting, hang-gliding, winter sports or racing other than on foot;

8. being a pilot or crew member (on active duty) of any aircraft, or engaging in any aerial activity, including parachuting and hang-gliding, except as a passenger in any properly licensed aircraft;

9. illness, disease, bacterial or viral infection, even if contracted by accident, other than bacterial infection that is the direct result of an accidental cut or wound or accidental food poisoning; or

10. provoked or unprovoked murder & assault.

Sanctions Exclusions Applicable to this Group Policy

This Group Policy does not apply to the extent that trade or economic sanctions or other laws or regulations prohibit us from providing insurance, including, but not limited to, the payment of claims. The Company is a branch of a US company and Chubb Limited, a NYSE listed company. Consequently, the Company is subject to certain US laws and regulations in addition to EU, UN and local sanctions restrictions which may prohibit it from providing cover or paying claims to certain individuals or entities or insuring certain types of activities related to certain countries such as Cuba.

SECTION 5 – GENERAL CONDITIONS

Where does this Group Policy apply?

This Group Policy insures the Insured twenty-four (24) hours a day anywhere in the world.

Enrollment

The enrollment declaration containing the details of the Insureds who enrolled under this Group Policy shall be submitted by the Policyholder to the Company via a Secured File Transfer Protocol (SFTP) site.

Breach of Conditions

If the Policyholder or the Insured is in breach of any of the conditions or provisions of this Group Policy (including a claims condition), the Company may decline to pay a claim, to the extent permitted by law.

Conditions Precedent to Liability

The Company’s liability for any benefit under this Group Policy is conditional upon the:

(i) truth of the statements and information as provided to the Company by the Policyholder and all Insured(s); and

(ii) due observance and fulfilment of the terms and conditions of this Group Policy insofar as they relate to

anything to be done or complied with by the Policyholder and all Insured(s).

Premium Payment

This Group Policy shall not be valid and binding unless and until the premium has been paid.

Grace Period

A grace period of thirty-one (31) days will be granted for the payment of each premium falling due after the first premium during which time this Group Policy shall continue in force, unless this Group Policy has been cancelled, terminated or has not been renewed in accordance with the provisions of this Group Policy. However, if loss occurs within the Grace Period for which the Company shall be obligated to pay benefits under this Group Policy, any premium then due and unpaid will be deducted in settlement.

Currency

All amounts shown in this Group Policy are in Philippine Peso (Php), unless specified in the Policy Schedule. If expenses are incurred in a foreign currency, then the rate of currency exchange used to calculate the amount payable in Philippine Peso (Php) will be the rate at the time the expense was incurred or the loss occurred.

Due Diligence

The Insured will exercise due diligence in doing all things to avoid or reduce any loss under this Group Policy.

Notice of Claim or Loss

In case of Injury or Accidental Death, written notice of claim must be given by the Insured to the Company within thirty (30) days after a covered loss occurs or as soon as is reasonably possible. Notice should include the Insured’s name and the Confirmation of Cover number.

Claim Forms

Upon receipt of a notice of claim, the Company will furnish to the claimant such forms usually required by it for filing proofs of loss. If such forms are not furnished within fifteen (15) days from receipt of such notice of claim, the claimant shall be deemed to have complied with the requirements of this Group Policy, as to proof of loss, upon submitting, within the time fixed in this Group Policy for filing proof of loss, written proof covering the occurrence, the character and extent of the loss for which the claim is made. All certificates, information and evidence, other than the usual claim forms, which the Company may reasonably require in support of a claim, shall be furnished by the Insured.

Proof of Loss

Written proof of loss including the original receipts, invoices and all other relevant documents must be furnished to the Company within ninety (90) days after the date of such loss. Failure to furnish such proof within the time required shall not invalidate nor reduce any claim if it was not reasonably possible to give proof

within such time, provided such proof is furnished as soon as reasonably possible and not later than one (1) year from the date of loss.

To Whom the Benefit is Payable

Benefits payable under this Group Policy shall be made to the Insured; or in the event of his death, to the beneficiary designated by the Insured provided such beneficiary is not legally disqualified and survives the Insured; or in the absence of beneficiary designation, to the person or persons then surviving in the following order of preference: (a) legal spouse; (b) children; (c) parents; (d) brothers and sisters; otherwise, to the estate of the Insured. Any payment made by the Company in good faith pursuant to this provision shall fully discharge it to the extent of the payment.

Time of Payment of Claim

Indemnities payable under this Group Policy will be paid within thirty (30) days after receipt by the Company of due written proof of such loss and after ascertainment of the loss is made by the agreement between the Company and the Insured or by arbitration; but if such ascertainment is not made within sixty (60) days after such receipt by the Company of the proof of loss, then the loss shall be paid within ninety (90) days after such receipt. Refusal or failure to pay the loss within the periods prescribed herein will entitle the Insured to collect interest on the proceeds of the Group Policy for the duration of the delay at the rate of twice the ceiling prescribed by the Monetary Board, unless such refusal or failure to pay is based on the ground that the claim is fraudulent.

Making Claims after this Group Policy is Cancelled

If this Group Policy is cancelled, this does not affect the Insured’s rights to make a claim under this Group Policy if the Event occurred before the date of cancellation.

Fraudulent Claims

If any claim under this Group Policy is fraudulent or if the Insured or anyone on the Insured’s behalf used any fraudulent means or devices to obtain benefit under this Group Policy, the Company shall have no liability in respect of such fraudulent claim and shall be entitled to terminate this Group Policy immediately.

Fraud Warning

Section 251 of the Amended lnsurance Code imposes a fine not exceeding twice the amount claimed and/or imprisonment of two (2) years, or both, at the discretion of the court, to any person who presents or causes to be presented any fraudulent claim for the payment of a loss under a contract of insurance, and who fraudulently

prepares, makes or subscribes any writing with intent to present or use the same, or to allow it to be presented in support of any claim.

Assistance and Cooperation

The Insured shall cooperate with the Company and upon the latter’s request, assist in making settlements, in the conduct of suits and in enforcing any right of contribution or indemnity against any person or organization who may be liable to the Insured because of Injury or damage wherein insurance is afforded under this Group Policy. In this regard, the Insured shall promptly attend hearings and trials and assist in securing and giving of evidence and obtaining the attendance of witnesses. The Insured shall not, except at the Insured’s own cost, voluntarily make any payment, assume any obligation, or incur any expense other than for payment of first aid expenses to others at the time of Accident.

Physical Examination and Autopsy

The Company at its own expense shall have the right and opportunity to examine the Insured when and as often as it may reasonably require during the pendency of the claim hereunder and to make an autopsy in case of death where it is not forbidden by law.

Misstatement of Age

If the age of the Insured has been misstated, all amounts payable under this Group Policy shall be such as the premium paid would have purchased at the correct age. In the event the age of the Insured has been misstated, and if according to the correct age of the Insured, the coverage provided by this Group Policy would not have

become effective, or would have ceased prior to the acceptance of such premium or premiums, then the liability of the Company during the period the Insured is not eligible for coverage shall be limited to the refund of all premiums paid for the period not covered by this Group Policy.

Right to Return Policy

In the event the Policyholder/Insured is not satisfied with the Group Policy/Confirmation of Cover for any reason, the Policyholder/Insured may cancel this Group Policy/Confirmation of Cover by advising the Company in writing within seven (7) days after receipt of this Group Policy/Confirmation of Cover. Any premium paid

will be refunded during this period. The Policyholder/Insured will not receive a full refund if the Insured has made a claim during this period.

Cancellation

This Group Policy, or any individual insurance provided thereunder, shall not be cancelled by the Company except upon prior written notice thereto to the Policyholder/Insured, and no notice of cancellation shall be effective unless it is based on the occurrence, after the Effective Date of this Group Policy, of one or more of the following:

a) non-payment of premium;

b) conviction of the Insured of a crime arising out of acts increasing the hazards insured against;

c) discovery of fraud or material misrepresentation;

d) discovery of wilful or reckless acts of omissions increasing the hazards insured against;

e) physical changes in the property insured which result in the property becoming uninsurable;

f) discovery of other insurance coverage that makes the total insurance in excess of the value of the property insured; or

g) a determination by the Insurance Commissioner that the continuation of this Group Policy would violate or would place the company in violation of the Insurance Code.

All notices of cancellation shall be in writing, mailed or delivered to the Policyholder/Insured at the address shown on the Policy Schedule and shall state (i) which of the grounds set forth in this provision is relied upon, and (ii) that, upon written request of the Policyholder/Insured, the Company will furnish the facts on which the

cancellation is based.

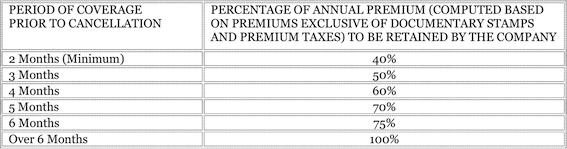

If the Policyholder/Insured cancels an annual policy, which must be in writing, the Company shall be entitled to retain a portion of the premiums computed in accordance with the applicable percentage indicated below, but in no event less than the Company’s customary minimum premium.

Such cancellation by the Policyholder/Insured shall become effective on the last day preceding the date the next premium is due and payable.

The Policyholder shall inform the Insured of the impending cancellation of this Group Policy by the Company

upon its receipt of the notice.

Clerical Error

A clerical error by the Company shall not invalidate insurance otherwise validly in force, nor continue insurance otherwise not validly in force.

Complying with Policy Conditions

The due observance and fulfillment of the terms of this Group Policy insofar as they relate to anything to be done or complied with by the Insured and the truth of the statements and answers in the policy application and

of evidence required from the Insured in connection with this Group Policy shall be conditions precedent to any liability of the Company to give any payment due under this Group Policy.

Renewal Conditions

This Group Policy may be renewed for further consecutive periods by the payment of premium on the Effective Date of the renewal at the Company’s premium rate in force at the time of renewal, subject to its right to decline renewal of this Group Policy on any anniversary date of the Group Policy upon giving forty-five (45) days prior written notice, mailed or delivered to the Policyholder at the address shown in this Group Policy, of the Company’s intention not to renew this Group Policy, or to condition its renewal upon reduction of limits or elimination of coverages. The Company’s acceptance of premium shall constitute its consent to renew. Unless

renewed as herein provided, this Group Policy shall terminate at the expiration of the grace period for which premium has not been paid.

Entire Contract

This Group Policy, including endorsements and attached papers of which the descriptive title is mentioned in this Group Policy, if any, the policy application on file with the Company or attached herewith and the Policy Schedule, constitute the entire contract of insurance. No change in this Group Policy shall be valid until

approved by an authorized executive officer of the Company and unless such approval be endorsed hereon or attached hereto. No agent has authority to change this Group Policy or to waive any of its provisions. None of the provisions, conditions and terms of this Group Policy shall be waived or altered except in accordance with

the pertinent provisions of Section 50 of the Amended Insurance Code.

Any rider, clause, warranty or endorsement issued after the Effective Date of this Group Policy shall be countersigned by the Policyholder, which countersignature shall be taken as the Policyholder’s agreement to the contents of such rider, clause, warranty or endorsement.

Governing Law

This Group Policy shall be governed by and interpreted in accordance with the laws of the Philippines.

Mediation

In the event of any controversy or claim arising out of or relating to this Group Policy, or a breach hereof, the Company and the Policyholder/Insured shall first endeavour to amicably settle the matter by mediation administered by the Insurance Commission or any recognized institution under the Mediation Rules, before

resorting to arbitration, litigation or some other alternative dispute resolution procedure.

Legal Action

Unless the claim has been denied, no action or suit shall be brought either to the Insurance Commission or any court of competent jurisdiction to recover on this Group Policy prior to the expiration of sixty (60) days after written proof of loss has been furnished in accordance with the requirements of this Group Policy. In any event, no legal action shall be brought after the expiration of twelve (12) months from notice of the denial of the claim.

Civil Code 1250 Waiver Clause

It is hereby declared and agreed that the provision of Article 1250 of the Civil Code of the Philippines (Republic Act No. 386) which reads:

“In case an extraordinary inflation or deflation of the currency stipulated should supervene, the value of the currency at the time of the establishment of the obligation shall be the basis of payment.”

shall not apply in determining the extent of liability under the provisions of this Group Policy.

Availability of the Group Policy

This Group Policy shall be kept in the main office of the Policyholder and shall be in the custody of its authorized officer. This Group Policy shall be available to the Insured for inspection during the regular office hours of the Policyholder.

Privacy Statement

In this Privacy Statement “We”, “Our” and “Us” means Insurance Company of North America (a Chubb Company). This Statement is a summary of Our Privacy Policy and provides an overview of how We collect, disclose and handle the Insured’s personal information, which may include sensitive personal information. Our

Privacy Policy may change from time to time and where this occurs, the updated version will be posted to Our website.

Why We Collect the Insured’s Personal Information

The primary purpose for Our collection and use of the personal information of the Insured is to enable Us to provide Our services (e.g. policy administration, inquiries, claims processing).

How We Obtain the Insured’s Personal Information

We collect personal Information (which may include sensitive personal information) at various points including but not limited to when We are issuing, changing or renewing an insurance policy or cover with Us or when We are processing a claim. Personal information is usually obtained directly from the Insured or through an

insurance intermediary or a group policyholder. Please refer to Our Privacy Policy for further details.

When information is provided to Us via a third party, We use that information on the basis that the Insured consented or would reasonably expect Us to collect the Insured’s personal information in this way. We take reasonable steps to ensure that the Insured has been made aware of how We handle his/her personal

information.

How We Disclose the Insured’s Personal Information

We may disclose the information We collect to third parties, including service providers engaged by Us to carry out certain business activities on Our behalf (such as claims assessors and call centers). In some circumstances, in order to provide Our services, We may need to transfer personal information to other entities within the

Chubb group of companies or third parties with whom We (or the Chubb Group of Companies) have subcontracted to provide a specific service for Us, which may be located outside of the Philippines. These entities and their locations may change from time to time. Please contact Us, if you would like a full list of the

countries in which these third parties are located. In the circumstances where We disclose personal information to the Chubb Group of Companies, third parties outside the Philippines, We take steps to protect personal information against unauthorized disclosure, misuse or loss.

Where access to Our products has been facilitated through a third party (e.g. insurance broker) We may also

share Your information with that third party.

Access to and Correction of the Insured’s Personal Information

If the Insured would like to request access to, update or correct the personal information held by Us, please contact Our Data Protection Officer.

How to Make a Complaint

In case of a complaint, please contact:

Data Protection Officer

Insurance Company of North America (a Chubb Company)

24th Floor Zuellig Building

Makati Avenue corner Paseo de Roxas

Makati City 1226, Philippines

E-mail DPO.PH@chubb.com

Contact Us

Insurance Company of North America

A Chubb Company

24th Floor Zuellig Building

Makati Avenue corner Paseo de Roxas

Makati City 1226 Philippines

O +63 2 8849 6000

F +63 2 8325 1675

About Chubb in the Philippines

Chubb is the world’s largest publicly traded property and casualty insurer. With operations in 54 countries and territories, Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance to a diverse group of clients. As an underwriting company, we assess, assume and manage risk with insight and discipline. We service and pay our claims fairly and promptly. The company is also defined by its extensive product and service offerings, broad distribution capabilities, exceptional financial strength and local operations globally. Parent company Chubb Limited is listed on the New York Stock Exchange (NYSE: CB) and is a component of the S&P 500 index. Chubb maintains

executive offices in Zurich, New York, London, Paris and other locations, and employs approximately 33,000 people worldwide.

Chubb, via acquisitions by its predecessor companies, has been present in the Philippines for more than 70 years. Chubb in the Philippines is a branch of Insurance Company of North America, which has been assigned a financial rating of AA by Standard & Poor’s. The company provides specialized and customized coverages for Property, Casualty, Marine, Financial Lines, as well as Accident & Health. It leverages global expertise and local acumen to tailor solutions to mitigate clients’ risks. With a focus on building strong relationships with its clients by offering responsive service, Chubb in the Philippines has become one of the leading providers of Specialty Personal Lines, Accident & Health insurance through direct marketing.

More information can be found at www.chubb.com/ph-en/

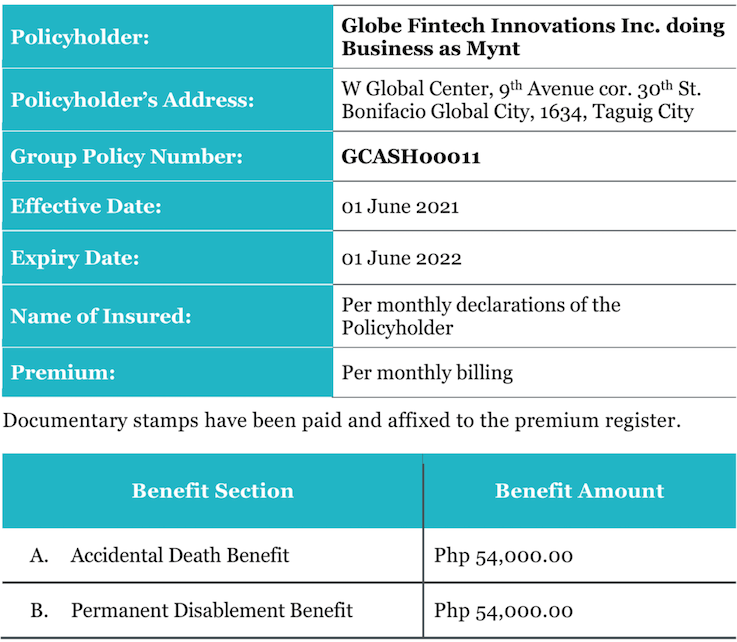

Policy Schedule

GInsure Bill Protect

Group Personal Accident

Insurance Policy

| Policyholder: | G-Xchange Inc., doing business as GXI |

|---|---|

| Policyholder’s Address: | W Global Center, 9th Avenue cor.30thSt.Bonifacio Global City,1634,Taguig City |

| Group Policy Number: | GCASH00011 |

| Effective Date: | 01 June 2021 |

| Expiry Date: | 01 June 2022 |

| Name of Insured: | Per monthly declarations of the Policyholder |

| Premium: | Per monthly billing |

Documentary Stamps have been paid and affixed to the premium register.

| Benefit Section | Benefit Amount |

|---|---|

| A. Accidental Death Benefit | Bill Amount x 36 paid via GCash |

| B. Permanent Disablement Benefit | Bill Amount x 36 paid via GCash |

In witness whereof, Insurance Company of North America (a Chubb Company) has caused this Policy Schedule to be issued on its behalf by the undersigned authorized representative.