You may not realize it, pero may investment ka na at some point in your life. You may have invested time and money in a college degree. Or, nag-invest ka in a job, a small business, or even a property. In due time, umaasa kang kumita from these investments.

Investing, therefore, ay ang pag-allocate ng resources into an asset. Each investment comes with the expectation na tataas ang value nito someday. While you can invest time and other resources, Investment 101 focuses on investing money. When done right, makakakuha ka ng profit o income. Eventually, these profits will help you build your personal wealth.

Later on, you’ll learn na hindi kumplikado o mahal ang pag-invest. Lahat tayo ay pwedeng maging investor with the right knowledge, time, and patience!

What you’ll learn from Investment 101

- Inflation, at kung paano nakakatulong dito ang investing

- Investment principles to remember bago mag-invest

- Common types of investments

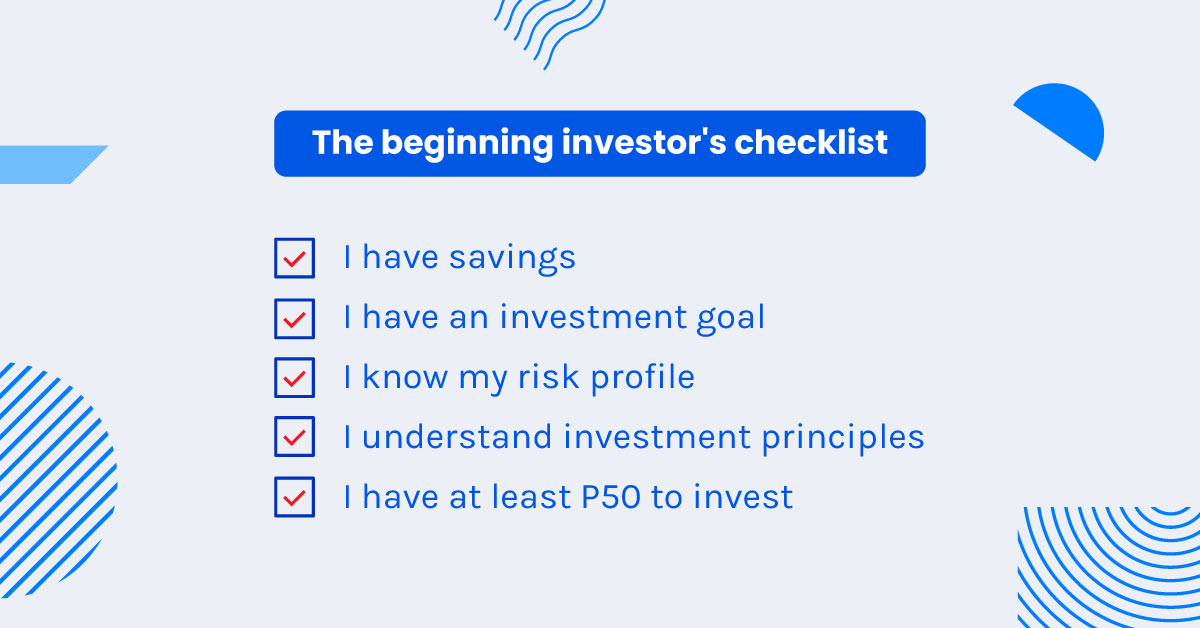

- Know if you’re ready to invest using The Beginning Investor’s Checklist!

The benefits of investing

It maintains your buying power kahit may inflation

To best illustrate the value of investing, we have to talk about inflation.

Every year ay tumataas ang presyo ng goods and services dahil sa pagbabago ng ekonomiya. This increase in prices over a period of time is called inflation. Sa pagtaas ng inflation rate, nababawasan din ang value ng iyong pera.

Let’s say na ang price ng paborito mong burger in 2020 ay Php 100. Inflation rate rose to 4.2% in 2021, kaya ang price nito ay tumaas rin to Php 104.2.

Kung patuloy na tataas ang inflation rate by 4.2% taon-taon…

| Year |

Burger Price (with 4.2% annual inflation) |

|---|---|

| 2020 | Php 100 |

| 2025 | Php 122.84 |

| 2030 | Php 150.90 |

| 2035 | Php 227.70 |

…by 2035 — which is 20 years from now — ang price ng burger mo ay Php 227.70 na. In short, halos half na lang ng burger ang mabibili ng Php 100 in 2035. Nakakalungkot, ‘di ba?

It’s best to have investments para masabayan ang pagtaas ng inflation rate (at pagmahal ng burger).

First, many investments earn higher interest than the 0.25-4% interest rate ng savings accounts. Compared to most savings accounts na fixed ang interest rate, the value of investments also change or increase.

It gets better if you’re an aggressive investor who earns dividends instead of interest. For example:

Nag-invest ka ng Php 10,000 sa stock market. Then, nag-save ka rin ng Php 10,000 in a savings account with 4% interest.

Ginalingan mo at nag-trade ka everyday sa stock market for 1 year. This resulted in your investment doubling to Php 20,000. Meanwhile, your savings increased to Php 10,400.

In this case, nalagpasan ng investment profits mo ang earnings ng iyong savings in the same amount of time.

Investments also earn compound interest

Second, investments take advantage of compound interest. It means na kumikita rin ng interest ang iyong investment earnings as time goes by. It’s a good way to prepare for long-term financial goals, such as retirement. So choose an investment an babagay sa iyong risk profile at goal timeline. Ito ay para mag-grow ang pera mo just in time to meet your investment goal.

Know these important investment principles

To make smart decisions, mahalagang maintindihan ng beginner investors ang mga sumusunod.

Investing has risk and rewards

Earlier, we mentioned that investments often have higher interest rates than most savings accounts. Still, hindi laging guaranteed ang growth ng iyong investment. All investments have a degree of risk. Ito ay dahil pwedeng bumaba in value o magsara ang businesses involved sa fund na iyong napili. Hence, laging may possibility na mawala ang parte o lahat ng perang iyong na-invest. Your investment may also not grow over time.

In principle: the higher the risk, the higher your potential earnings will be. Due to this risk, you need savings before investing. Accordingly, you also need to know your risk profile and investment goals. These will guide you sa pagpili ng investment that meets your timeline and expectations.

Don’t put all your investment eggs in one basket

To reduce risk at losses, mag-invest sa iba’t ibang types of products. Furthermore, these products should have different levels of risk. Ang tawag sa technique na ito ay diversification. Kapag bumaba ang value ng isang investment, hopefully ay tataas o mare-retain lang ang value ng iba mong investments. This ensures na hindi ka mawawalan ng pera.

The earlier you invest, the more potential rewards you’ll gain

Long-term commitment ang investments. Kaya naman it’s best to start early! The reason is para mas maraming maipon na compounding returns ang iyong initial investment.

When you’re younger, mas mataas din ang iyong tolerance for risk. Choosing high-risk investments at this stage gives you an early start sa pag-grow ng iyong personal wealth. You also have enough time to recover from investment losses.

The most common types of investments

Maraming investment products from different banks at financial institutions. As a beginner, these are the ones you’ll encounter most.

Stocks

Stocks are a small ownership of any company in the stock market. When you buy a stock, you become a stockholder of a company. Tutubo ang iyong investment when the company grows, at mawawalan ka ng pera when it stumbles.

To make a profit, you buy a stock kapag mababa ang price nito, and sell it kapag tumaas ang price. This is called stock trading. Unpredictable at pabago-bago ang value ng stocks araw-araw. It’s why trading requires attention, expertise, and willingness to take multiple risks.

Bonds

When you buy bonds, pinapautang mo ang pera mo sa isang company o government agency. Each bond comes with a guarantee na magbabayad sila ng set amount over a certain period of time. In addition, magbabayad din sila ng interest rate sa kanilang utang.

Regardless of the company or agency performance, you’ll receive interest payments hanggang mabayaran ka in full. This makes bonds low-risk, but low-profit investments.

Funds

Admittedly, complex at time-consuming ang pag-invest sa stocks at bonds. This is why many investors choose to have their money managed by a professional fund manager. Ang fund manager na ang gagawa ng decisions at bibili ng various assets (such as stocks and bonds). They will choose the best mix para magka-profit ang investment. This pooled money from multiple investors is called managed funds or investment funds.

We recommend this especially for beginners. Ito ang pinaka-affordable, guided, at convenient investment option.

Ngayong may alam ka na, are you ready to invest?

We’ve covered the reasons why you need most of the items sa checklist above. Now, let’s talk about much capital you need to invest.

The good news is you can invest for as low as Php 50! It’s the minimum order requirement of GInvest, ang investment marketplace feature ng GCash. Here, you can avail different funds galing sa fund management corporation of ATRAM Trust Corp.

Through GInvest, lahat ng investment transactions mo ay magagawa within the GCash App. Kasama na rito ang pag-open ng investment account hanggang sa pag-add ng pera sa iyong fund. May risk profile questionnaire rin ang GInvest. Thus, you’ll immediately know kung anong fund ang best fit sa iyong risk profile.

Confident with your knowledge at expertise sa pag-invest? Pwede kang mag-open ng online stock trading account. You can also avail bonds and other investments mula sa local banks o sa Bureau of Treasury.

Wherever stage you’re at in your investing journey, check out our next lesson on knowing your best investment options.This is para makapili ka ng investment that fits your goals. More importantly, time is your friend pagdating sa investing. So commit to it as early as now!