Do you still use your sock drawer o kutson sa bahay as a savings account? If yes, then we won’t judge!

However, hindi ideal ang pagtatago ng savings sa bahay. Besides being prone to theft or calamity, it reduces the buying power of your savings due to inflation. Inflation ang pagtaas ng presyo ng goods and services over a period of time. Sa pagtaas ng inflation rate, bumababa rin ang value ng iyong pera.

For example: Nag-iipon ka ng Php 20,000 na pambili ng Gucci bag on your 30th birthday. If that’s ten years from now, then tataas pa ang current price ng bag. Thus, by 2031, kulang na ang iyong Php 20,000. This is especially kung tinago mo lang ang pambili sa bahay.

So para hindi mabawasan ang value ng pera, it’s best to deposit savings into a savings account. It’s the safest place to keep money for short-term and long-term goals. Because savings accounts earn interest, ito rin ang easiest, most accessible way to earn passive income.

Sa dami ng savings accounts out there, mapipilitan ka talagang mag-research to find the best one for you. Para hindi ma-overwhelm with features, always review these factors before mag-sign up.

Factors to review when choosing a savings account

- Interest rate. The annual percentage of your savings na nakukuha mo mula sa bangko for keeping your money deposited. Getting a high interest rate ensures that your savings will grow faster.

- Initial deposit. Ito ang minimum amount required to open an account.

- Maintaining balance. Ito ang amount na dapat maiwan sa account every month to avoid maintenance fees.

- Additional interest rates. Some savings accounts offer higher interest rates when you meet certain account balances. For example, GSave has a base annual interest of 2.6%. However, pwede itong tumaas up to 4% kapag nag-maintain ka ng average daily balance of P100,000.

- Fees, taxes, and charges. Ang naipong interest ng iyong account ay subject sa 20% final withholding tax from BIR. Also, you may be charged for not meeting the maintaining balance. May other charges din for going over the free number of withdrawals, closing the account, and more.

- Freebies. May mga savings accounts with free insurance, credit card, personal checks, cash credits, o iba pang rewards.

- Your personal saving habits. How often do you deposit or withdraw? Do you need to work on your impulse control? Then choose an account that’s forgiving in terms of fees, charges, or multiple withdrawals.

With this in mind, heto ang iba’t ibang savings accounts na available sa Pilipinas sa ngayon.

Online savings account

Recommended for: first-timers, tech-savvy savers, at depositors na gustong kumita agad mula sa kanilang savings

Online savings accounts are offered by digital banks. From registration to withdrawal, lahat ng account management ay via online o mobile banking. Dahil kaunti lang ang kanilang operating expenses such as rent o manpower, they can offer higher interest rates than traditional banks.

One example is CIMB Bank PH, which offers interest rates from 2.6% to 4%. Wala silang fees, initial deposits, at maintaining balance required. Insured din ng PDIC ang kanilang savings accounts.

For first-time savers na nagde-develop pa lang ng saving habits, ideal ang online savings accounts. Walang charges o fees kung hirap kang mag-deposit regularly.

Pros

-

- Mas mabilis mag-grow ang savings due to higher interest rates

- No minimum deposit, maintaining balance, and fees

- Accounts are managed online or via mobile banking

- Less requirements compared sa regular savings accounts Save

- Pwede kang gumawa ng account online

Cons

-

- No bank branches

- Withdrawals may or may not be possible via ATMs

- Transfers may not appear in real time

Regular savings account

Recommended for: account holders who prefer physical bank branches, at depositors na hindi concern ang pagkakaroon ng mataas na interest rate

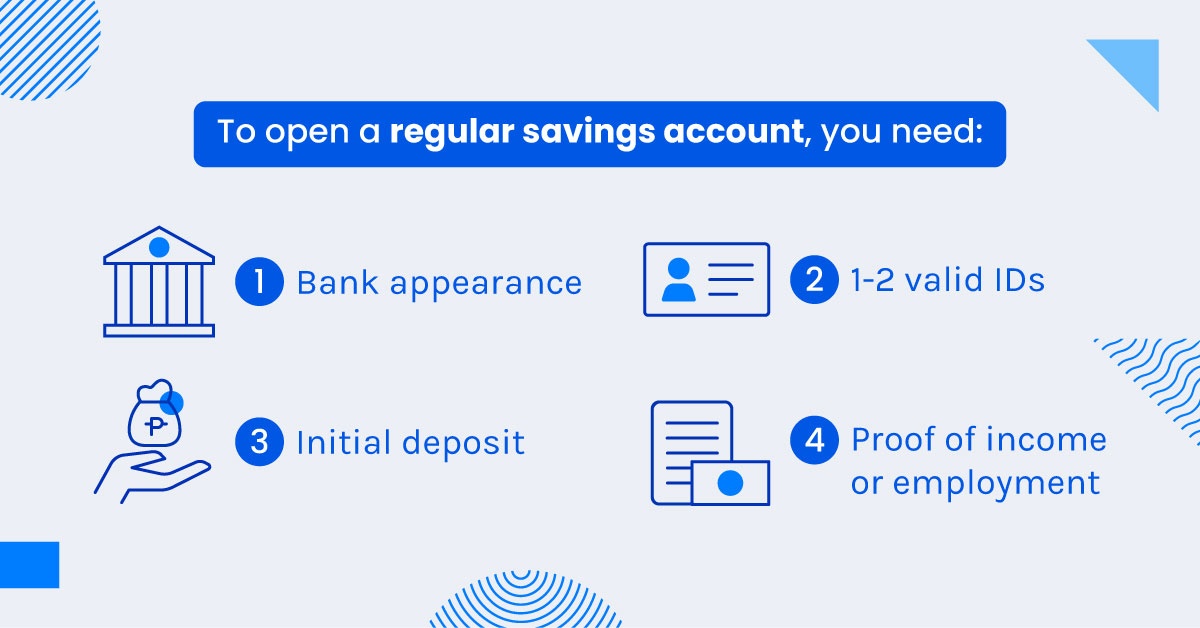

Ito ang savings accounts from traditional local banks. Their average interest rates are around 0.5%-2%. Compared to online savings, regular savings accounts are strict with fees pagdating sa maintaining balance or excess withdrawals. Mas marami rin silang requirements to open an account. These are usually two valid IDs, proof of residence at income, and initial deposit.

Bagay ang regular savings accounts sa depositors na mas gustong mag-transact sa bank branches. However, most local banks now offer mobile at online banking. Mas madali rin ma-access ang funds from regular savings accounts na may ATM cards..

Pros

-

- Pwedeng pumunta sa bank branch for transactions or assistance

- Accounts can also be managed online or via mobile

- Pwedeng mag-withdraw through ATMs

- You can issue checks if you choose a checking type of account

Cons

-

- Lower interest rates compared sa online savings accounts

- Pwedeng makain ng fees at charges ang iyong interest earnings

- Maraming requirements bago makapag-open ng account

Time deposit accounts

Recommended for: depositors na hindi kailangan mag-withdraw any time soon

Time deposit accounts are accounts na may lock-in period. Depending sa pinili mong time frame, you need to maintain your money sa account for 30 days, 60 days, 180 days, o 1-7 years. To withdraw before the end of the lock-in period, most banks require you to meet with a bank representative. May malaking penalty din ang early withdrawals.

Time deposits can be availed from traditional banks. While they offer high interest rates (1%-3.9%), they also require high initial deposit (also called ‘minimum placement’). For most banks, ang minimum placement ay mula P50,000 to P100,000.

Pros

-

- Pwedeng pumunta sa bank branch for transactions or assistance

- Accounts can also be managed online or via mobile

- Pwedeng makakuha ng high interest rates

- Limited ang access sa savings to ensure it grows

Cons

-

- Non-flexible at mahirap i-withdraw in case of emergencies

- Maraming requirements bago makapag-open ng account

- In case of early withdrawal, makakain ng malaking penalty ang earnings

Specialty savings accounts

Recommended for: depositors na may specific goal na pinag-iipunan

Specialty savings accounts are designed for specific goals. Some examples are savings accounts for kids, OFWs, college funds, o property downpayment. Maraming special features ang mga ito na hindi available sa regular savings account. Some of them have low initial deposits, free insurance, o automated transfers.

Pros

-

- Helps you save for a specific financial goal

- Depending on the account, you can enjoy special features

Cons

-

- Some accounts have strict withdrawal and deposit policies

- Depending on the account, madalas ay mababa ang interest rate

- Limited to specific groups such as OFWs and students

Real talk: Ano ang best savings account?

Online savings accounts ang may highest interest rates. Therefore, kikita agad ang iyong savings in a shorter period of time. Madali rin itong i-manage using your mobile phone.

We recommend GSave, ang savings account ng GCash at CIMB PH. Here’s why:

- 2.6% interest per annum, which can be upgraded to 4% by meeting certain conditions

- Access your savings 24/7 via GCash at CIMB PH app

- No required initial deposit, maintaining balance, or withdrawal fees

- Open an account sa GCash app instantly with 1 valid ID

- May free life insurance ito when you meet certain conditions

- May iba pang services within the GCash app. Thus, you can withdraw your savings sa app and use it immediately to buy load, send money, pay bills, and more.

In summary, choose an account that fits your saving habits, immediate needs, and saving goals! By having a convenient savings account, mas madali mong mabi-build ang habit of saving.